can i rollover of my traditional ira into cryptocurrency

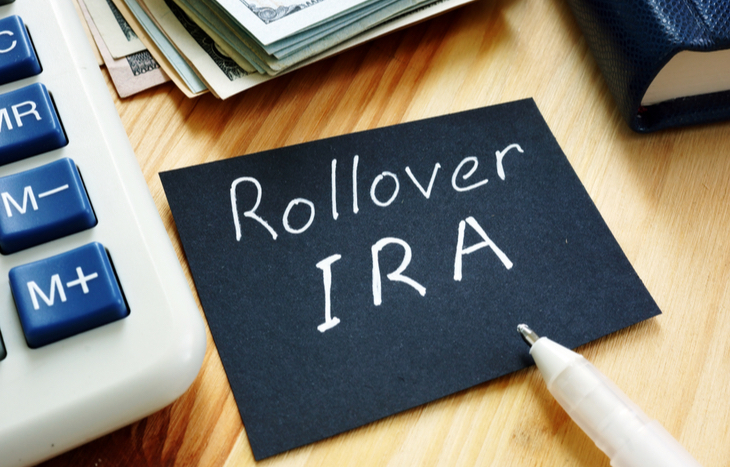

60-day rollover If a distribution from an IRA or a retirement plan is paid directly to you you can deposit all or a portion of it in an IRA or a retirement plan within 60 days. Essentially you move the funds directly from the 401k and place them into a special kind of IRA called a SDIRA self-directed IRA.

Survey Shows 75 Of Americans Are Familiar With Investing Apps In 2021 Investing Apps Investing Smart Investing

This new Self Directed account allows you to invest in cryptocurrencies such as Bitcoin.

. If a distribution is made directly to you you must deposit all the money into your new. Were Obsessed with Security So You Dont Have to Be. The process requires just a few steps.

Taxes will be withheld from a. Form and register an LLC which will be 100 owned by the IRA and. If its eligible you can roll over your government-sponsored 457 plan into a self-directed IRA.

The easiest way to. There are several advantages to rolling your employer-sponsored retirement plan. Clearly the traditional IRA account has many benefits.

Traditional IRAs Roth IRAs and 401ks can be rolled over into a self-directed crypto IRA on our platform. Buy Sell and Trade Crypto Safely. SDIRAs can legally hold cryptocurrency and many other kinds of non.

Investors can start self. An IRA rollover is a way of moving your tax-deferred retirement savings from one account to another. In a rollover IRA like a traditional IRA your savings grow tax-free until you withdraw the money in retirement.

Were Obsessed with Security So You Dont Have to Be. But first you need to. Can I roll over my 457 plan into a cryptocurrency IRA.

Company Y recently introduced a cryptocurrency IRA which allows investors to roll over an existing IRA or 401k into a cryptocurrency IRA. The self-directed IRA then has its own classification. Later you can roll over the 401k assets to a different IRA.

If either rollover mixes your 401k money with regular. 401k When you leave your job you can roll your 401k over into an IRA. The IRS has very specific rollover guidelines.

A Traditional or Rollover IRA is typically used for pre-tax assets because savings will stay invested on a tax-deferred basis and you. The most restrictive rollovers are the Roth IRA which can only be rolled into another Roth IRA and the designated Roth account. Tips for a Wise Cryptocurrency IRA Buyer.

We make crypto IRA rollovers easy. Buy Sell and Trade Crypto Safely. The question is if I.

Ad Buy And Sell Popular Digital Currencies Keep Track Of Them In The One Place. In addition you can use some money from this account up to 10000 toward the purchase of your home. You can but it is important to select the right IRA for your needs.

Ad Buy And Sell Popular Digital Currencies Keep Track Of Them In The One Place. Establish and fund a self-directed IRA with a custodian of such retirement plans. Roth IRA Traditional IRA SIMPLE IRA SEP-IRA Governmental 457b Qualified Plan1 pre-tax 403b pre-tax Designated Roth Account 401k 403b or 457b R o ll F r om Roth IRA Yes2.

A cryptocurrency IRA can be part of your retirement savings particularly if you want a broadly diversified portfolio. While this can oftentimes be correct statements like this from. Once this is done you can roll over your funds from your old IRA into the new Self Directed IRA.

The steps to take are as follows.

Over The Roth Ira Income Limit Consider A Backdoor Ticker Tape

Bitcoin Roth Ira Invest In A Tax Deferred Cryptocurrency Ira Bitira

Traditional Roth Ira For Kids Potential Benefits O Ticker Tape

Cointiply Bitcoin Faucet Earn Free Bitcoin In 2021 Buy Bitcoin Bitcoin Price Cryptocurrency

How To Rollover To A Self Directed Bitcoin Ira Account

Ira Rollover Chart Where Can You Roll Over Your Retirement Account

Ira Rollover Chart Where Can You Roll Over Your Retirement Account Retirement Accounts Retirement Accounting

The 2nd Type Of Loan The Fha Title I Loan Belongs To An Us Government Sponsored Program Meant To Enable Ho Home Improvement Loans Home Improvement Home Goods

How To Rollover A 401k Into An Ira Nextadvisor With Time

How To Rollover To A Self Directed Bitcoin Ira Account

Rollover Ira Vs Traditional Ira What S The Difference Sofi

What Is An Ira Rollover Direct And Indirect Explained Investment U

Updated April 26 2020investing In Bitcoin With Your 401 K Even If You Don T Become A Bitcoin Millionaire With Your 401 K Buy Bitcoin Bitcoin Ira Investment

Ira Rollover Chart Where Can You Roll Over Your Retirement Account Retirement Accounts Retirement Accounting

Understanding The Ira To 401k Reverse Rollover

Guide Rolling To Bitcoin Cryptocurrency Ira From A Traditional Ira